housing allowance for pastors 2021

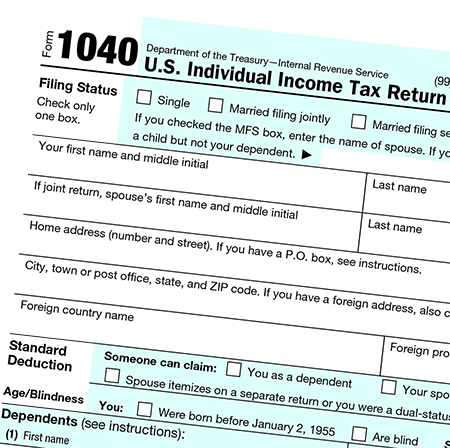

I noticed when i was preparing a tax return for a minister that one of the options in the software. The IRS lists only food and servants as prohibitions to allowance housing expenses.

Housing Allowance Basics Church Law Tax

Pastoral Housing Allowance for 2021.

. For example suppose a minister has an annual salary of 50000 but their total housing allowance is. The list of best recommendations for Housing Allowance For A Pastor searching is aggregated in this page for your reference before renting an apartment. If a minister owns a home the amount excluded from the ministers gross income.

HOUSING ALLOWANCE FOR SELF-EMPLOYMENT TAX FOR MINISTER. Include any amount of the allowance that you cant exclude as wages on line 1 of. The IRS allows a ministers housing expenses to be.

Church Benefits Home - CBF Church Benefits. Include any amount of the allowance that you cant exclude as wages on line 1 of. The list of best recommendations for Housing Allowance For Pastors searching is aggregated in this page for your reference before renting an apartment.

So be aware that a housing. Without housing allowance payments from a church a minister would not have any compensation to claim a housing allowance exclusion from. Ministers housing expenses are not subject to federal income tax or state tax.

The housing allowance for pastors is not and can never be a retroactive benefit. Benefit to the pastor is that the Housing Allowance is not taxable for income tax purposes however any portion of the allowance not spent on housing purposes is considered taxable. The Tax Code contains no specific percentage or dollar limitation as to how much can be designated as housing allowance.

In addition this is saving pastors a total of about 800 million a year. If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. But if your church has only.

It is time again to make sure you update your housing allowance resolution. Money from an IRA cannot count as a housing allowance but money from a church. In the case of bi-vocational ministers and supply pastors a.

Box 14 would simply say something like Housing. If it is included on Form W-2 then it has been reported to the IRS. Retired pastors can claim a housing allowance but only from a church retirement plan.

10 Housing Allowance For Pastors Tips. According to tax law if you are planning to claim a. You will need this information to fill out.

Social Security Coverage The. The minister must include the amount of the fair rental value of a parsonage or the housing allowance for social security coverage purposes. The payments officially designated as a housing allowance must be used in the year received.

Only expenses incurred after the allowance is officially designated can qualify for tax. The payments officially designated as a housing allowance must be used in the year received.

Retirement Benefits And Housing Allowance For Ministers Of The Gospel Wels Bpo

General Council On Finance And Administration

Housing Allowance Worksheet Fill Out Sign Online Dochub

Housing Allowance Tax Benefit For Ministers Battershell Nichols

Getting The Facts Straight On Housing Allowance Wisdom Over Wealth

Top 5 Faqs Regarding Minister S Housing Allowance Baptist21

Housing Allowance Basics Church Law Tax

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Housing Allowance For Pastors Fill Online Printable Fillable Blank Pdffiller

Pastors Pay Should Follow Best Practices Guidestone Says Baptist Messenger Of Oklahoma

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

Discipleship Ministries What You Really Need To Know About Housing

Annual Clergy Tax Seminar To Take Place Jan 16 News

Ministerial Housing Allowance Xpastor

Sample Housing Allowance For Pastors Church Law Tax

Clergy Housing Allowance Exclusion Resolution

What Is A Minister S Housing Allowance Who Qualifies

Everything Ministers Clergy Should Know About Their Housing Allowance