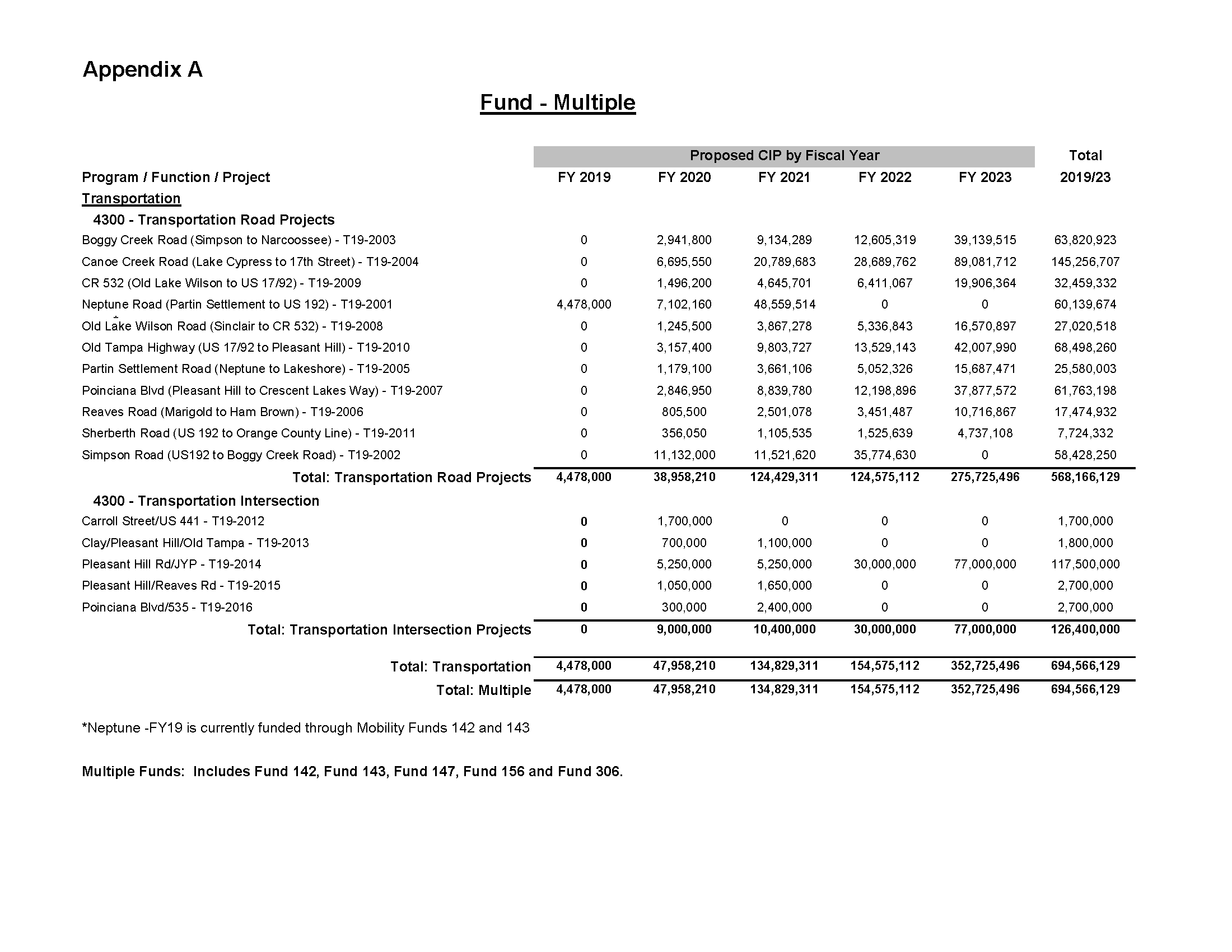

osceola county property tax rate

Scarborough CFA CCF MCF April 22 2022 413 pm. Please contact the Collector office at 704 920-2119 to get your plan for payments.

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

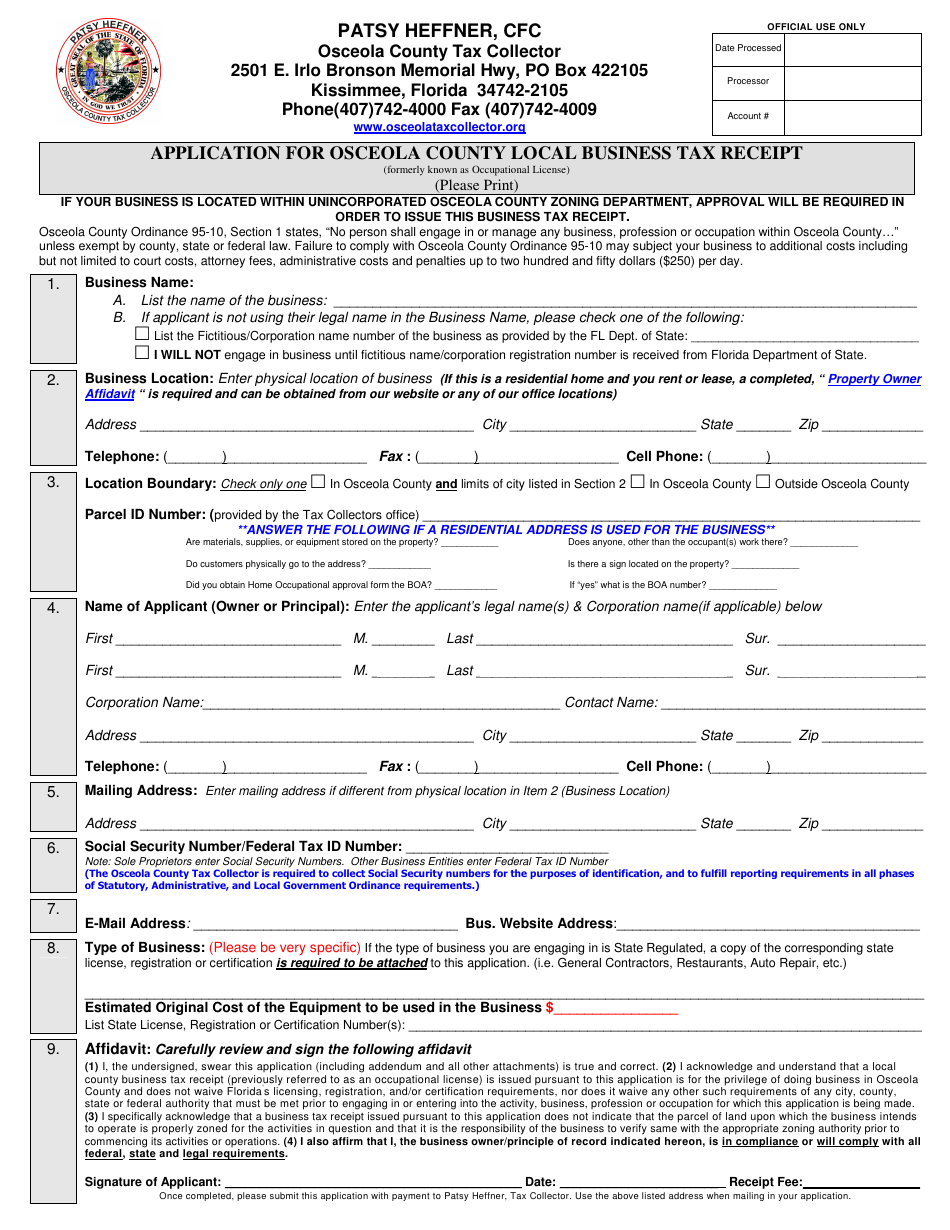

OSCEOLA COUNTY TAX COLLECTOR.

. Osceola County Clerk of the Circuit Court Kelvin Soto 2 Courthouse Square Kissimmee Florida 34741 407 742-3500. Current tax represents the amount the present owner pays including exemptions. Compared to the state average of 121 homeowners pay an average of 000 more.

Property owners are required to pay property taxes on. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan.

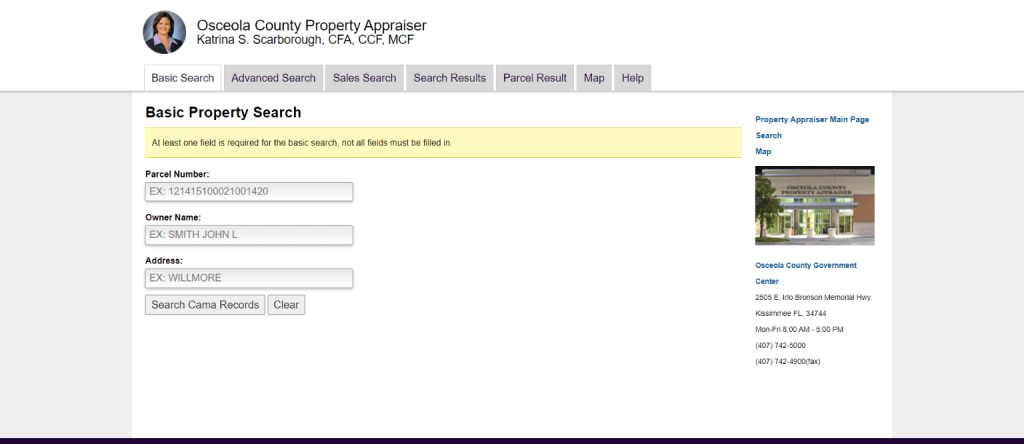

Start Your Homeowner Search Today. Search by Name through Property Building Department and Tax Records. Effective July 1 2004 the Tourist Development Tax increased to 6 in Osceola County.

This property is fully exempted from paying taxes. Learn all about Osceola County real estate tax. Search all services we offer.

If you are unable to pay your tax in full then you can make partial payments. The 2021 Winter Tax bills were mailed Wednesday December 1st 2021. Although the millage rates did not increase the Adopted Budget contains the necessary expenditures to maintain the delivery of exceptional services to the citizens and visitors of Osceola County while maintaining a focus on.

Parcel Number Search by Parcel Number through Property Building Department and Tax Records. The total rental charge is any. Osceola County Tourist Tax for HomeAway VRBO and FlipKey.

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. You can also make full or partial pre-payments before your annual tax statement. The Tourist Development Tax is a charge on the total rental amount charged to a guest for any short term rental less than 180 days.

Irlo Bronson Memorial Hwy. 407-742-3995 Driver License Tag FAX. The overall proposed tax rate also remains the same as last year -- at 82308 mills for the general fund EMS library and environmental lands.

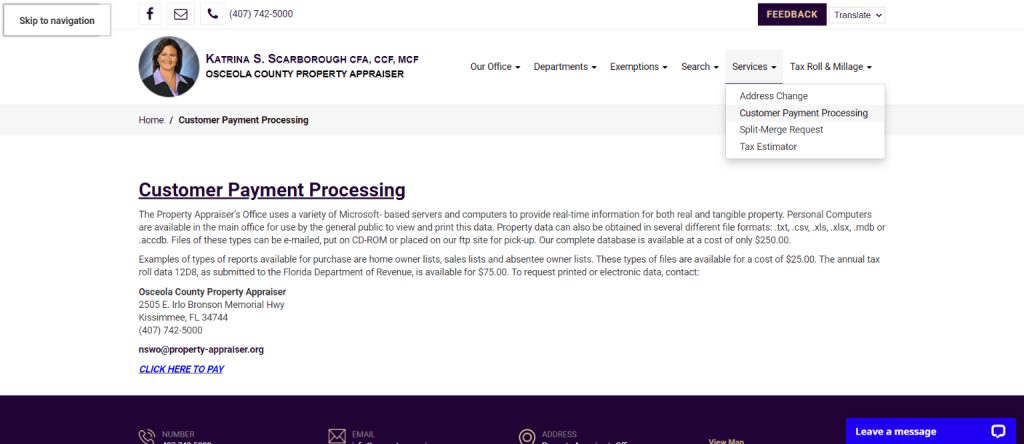

Osceola County Florida Property Search. Osceola County Property Appraiser Katrina S. To be eligible for the program the taxpayers estimated taxes must be in excess of 10000.

407-742-4037 Property Taxes FAX. Osceola County Tax Collector - Office of Bruce Vickers. The Tax Collectors Office provides the following services.

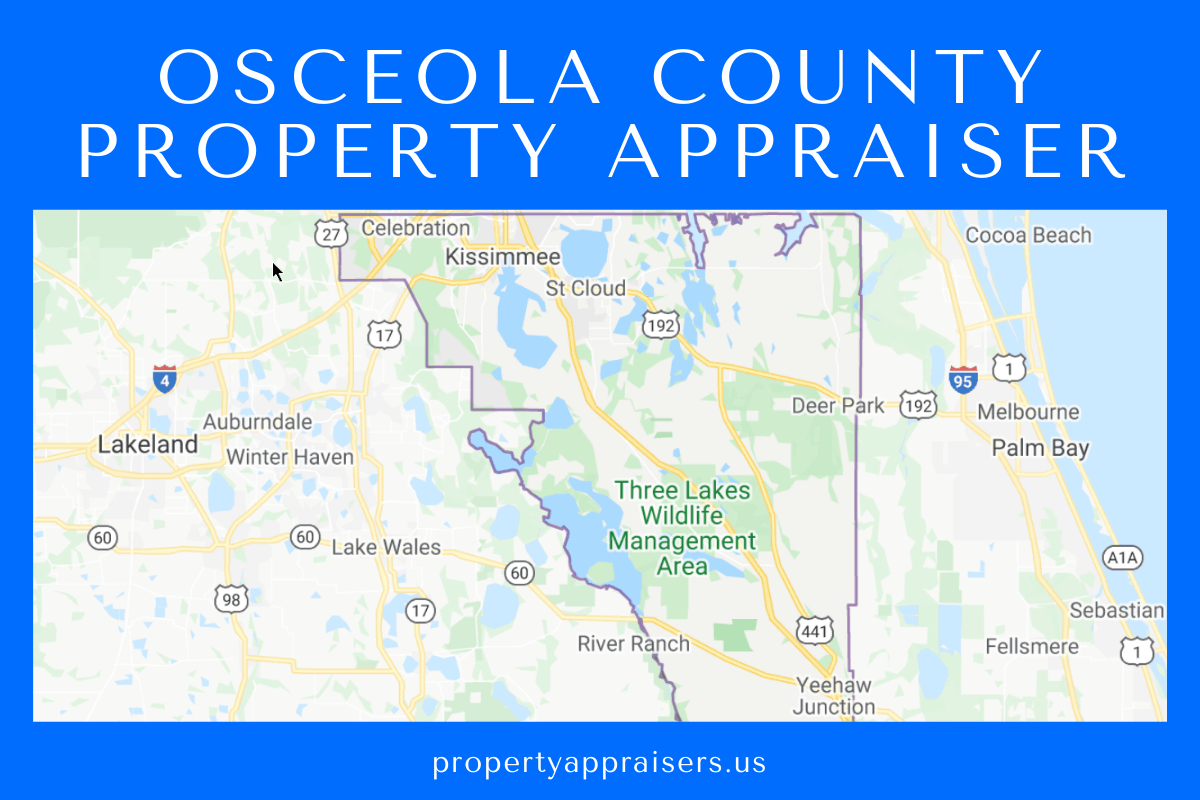

Put another way if you live in Osceola County you can expect to pay 1210 for every 1000 of real estate value or 121. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. Osceola County Property Appraiser.

Set tax rate to 135 by doing so you are collecting the proper occupancy tax for your vacation rental. Osceola Tax Collector Website. Learn how Osceola County levies its real property taxes with our detailed review.

What does this mean. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. How to pay tourist development tax for my vacation rental in Osceola Step 1.

You must remit a monthly tourist tax return to Osceola county. 2505 E Irlo Bronson Memorial Highway. If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location.

Visit their website for more information. File the Osceola County Tourist. Tonia Hartline 301 W.

After 500pm After this time all unpaid taxes will be sent as delinquent to the Livingston County Treasurer. Overview of Osceola County FL Property Taxes. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

This Tax Estimator is intended to assist property owners estimate future taxes. Such As Deeds Liens Property Tax More. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Are you or do you know someone who is purchasing a new home. Under Florida law e-mail addresses are public records. These taxes are due Monday February 28 2022 by 500pm.

These are deducted from the assessed value to give the propertys taxable value. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. We suggest you check out the Tax Estimator feature listed under the services section of my website.

Please correct the errors and try again. Search Valuable Data On A Property. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

Out of the 67 counties in Florida Osceola County has the 5th highest property tax rate. Search Use the search critera below to begin searching for your record. If you would like to pay when we are closed or prefer not to come inside we have a walk-up secured drop.

Ad Get In-Depth Property Tax Data In Minutes. Tourist Development Tax Osceola County Code of Ordinances Chapter 13 Article III Tourist Development Tax.

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Fl Property Tax Search And Records Propertyshark

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser How To Check Your Property S Value

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Property Appraiser How To Check Your Property S Value